Whatcom County Tax Assessed Value of Property in 2023

So, Whatcom County just did a thing: They jacked up your assessed values and added some new fees.

The Only Numbers That Matter

First, let's talk numbers because numbers don't lie—people do. The total taxable assessed value in Whatcom County catapulted from $43.16 billion in 2022 to a whoppin' $52.49 billion in 2023. That's a 21.6% increase, folks. And your property taxes? Oh, they're taking a joyride too, up 9.2% from last year. That's an extra $37.5 million the county is raking in, and about 41% of that comes from those voter-approved measures you probably forgot you voted for. Democracy, amirite?

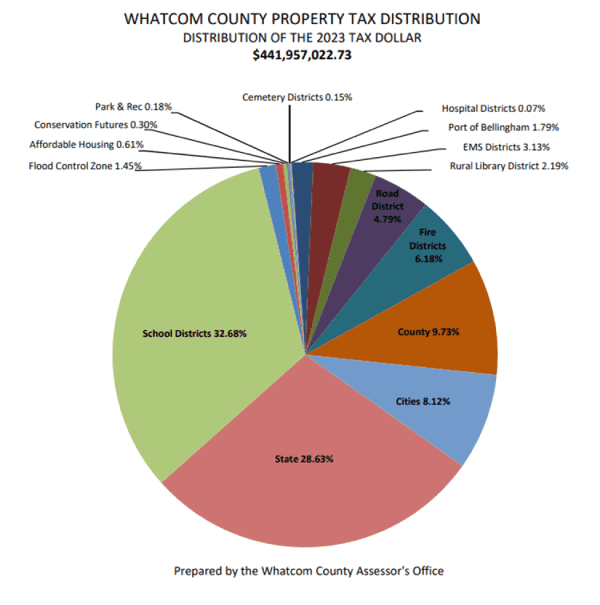

Here's a fancy pie chart of where your money is going.

Just Because Your Assessed Value Went Up Doesn't Mean Your Taxes Will

I mean, let's be honest, they probably will go up. However, Whatcom County's tax game mostly runs on budget-based levies. Think of each district's budget like a pie. Your slice of the pie is determined by how much your property is worth. So if everyone's property value goes up, don't sweat; your tax amount stays the same. But if the district's budget gets fatter, brace yourself for a bigger bill. State levies? Well, they flip-flopped from rate-based to budget-based recently, but they've got their own set of rules, like caps and such. Get it? Good.

How to Not Get Screwed Over By Your Property Assessment

Look, you don't have to take this lying down. If your property assessment has you raising an eyebrow, here's your step-by-step guide to, you know, not getting screwed.

Step 1: File an Appeal, Like, Yesterday

First, go grab an appeal petition from either the Clerk of the Board or the Assessor's Office. File that bad boy by July 1st or within 30 days of getting your value change notice. Or you could just procrastinate and pay more; your call.

Here's the link - https://www.whatcomcounty.us/180/Board-of-Equalization-Appeal-Property-As

Step 2: Have a Chat with the Assessor's Office

Before you get all litigious, maybe just call up the Assessor's Office and ask, "Hey, what gives?" They might just correct it, and you'll save yourself a lot of stress and possibly some money.

Step 3: Get Formal, if You Must

If chatting doesn't do the trick, put on your big-kid pants and file a formal appeal with the County Board of Equalization. Just remember, these guys only care about value, not your sob story about how the taxes will force you to live off ramen noodles.

Convince them the assessment is whack. Show them sales of comparable properties, or other evidence like how your land can't even support a tool shed, let alone a house. Make it solid; vague rants won't cut it.

Step 4: Go Big or Go Home

If the County Board snubs you, kick it up to the State Board of Tax Appeals. Still not satisfied? Hell, take 'em to court. Just know each step has its own flavor of pain and paperwork.

Need More Info? Fine, Here You Go

If you need to get into the weeds, the County Board of Equalization has a webpage you can peruse. But honestly, after this, you should pretty much be a tax assessment ninja.

So there it is. Don't just be a victim of the system; understand it, challenge it, and keep your hard-earned money where it belongs: in your pocket, not theirs.

Cheers,

Briddick

Categories

Recent Posts

Managing Broker | License ID: 26476

+1(360) 920-1218 | briddick@agentsinbellingham.com